Public Bank Islamic Housing Loan

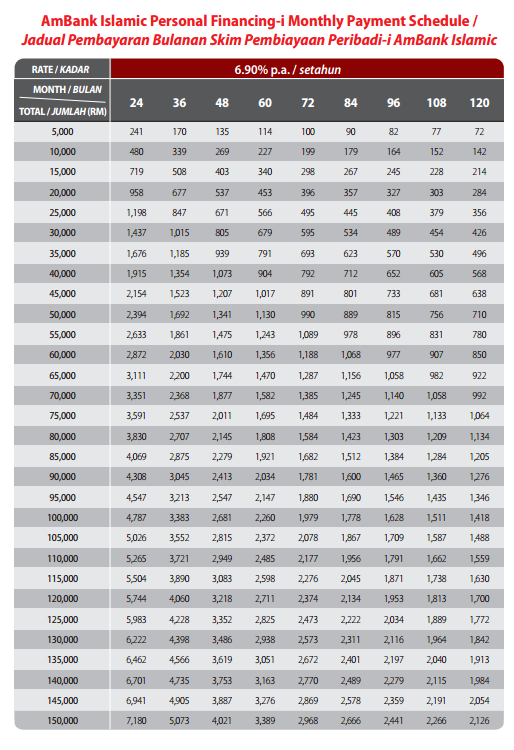

Public islamic bank homesave i package is a shariah based financing concept which is links your home financing to your current account i whereby the credit balances in your current account i will be used to reduce the home financing outstanding balance for profit calculation thus resulting in profit savings.

Public bank islamic housing loan. Public bank a complete one stop financial portal offering a range of accounts credit cards loans deposits and other financial aids for our personal and commercial customers. Public islamic bank home loan packages public islamic bank offers property financing based on musharakah mutanaqisah and bai bithaman ajil specifically designed for islamic banking costumers. 5 home plan gives you the flexibility of choosing from a wide range of different home financing packages depending on your financial needs. 8 45 am 5 45 pm.

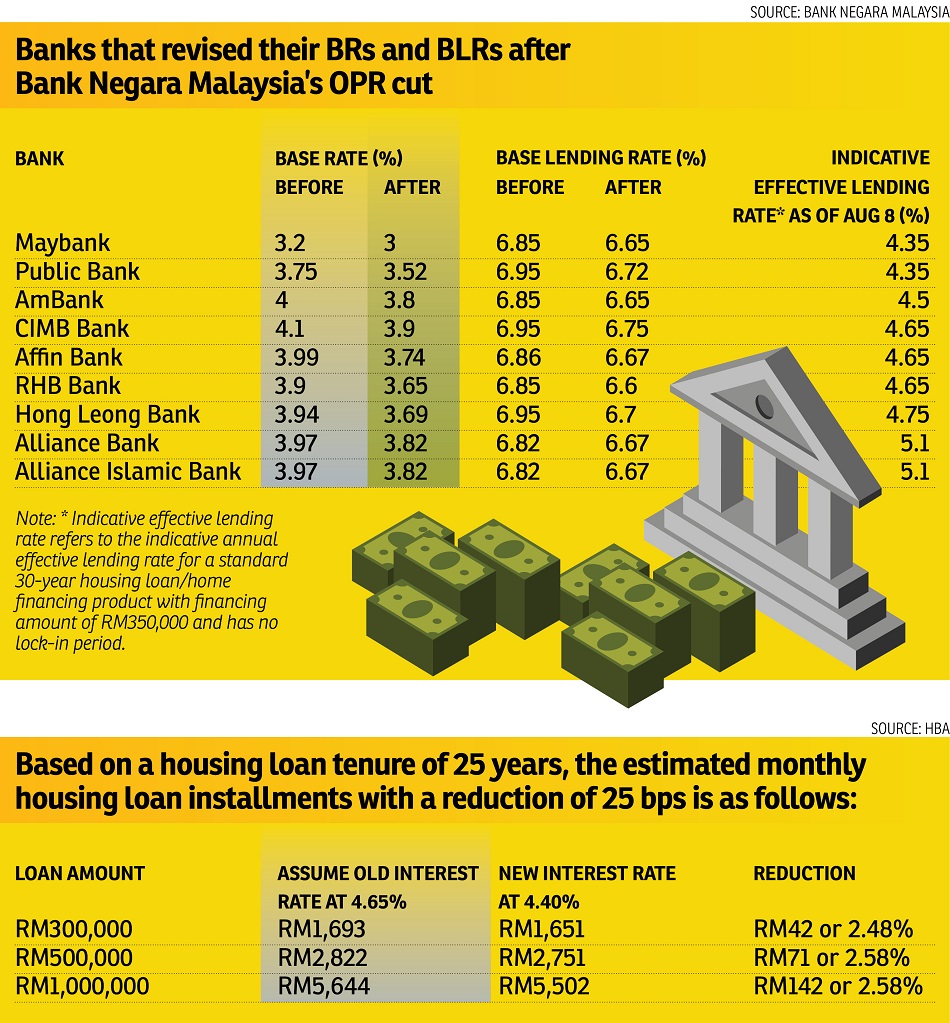

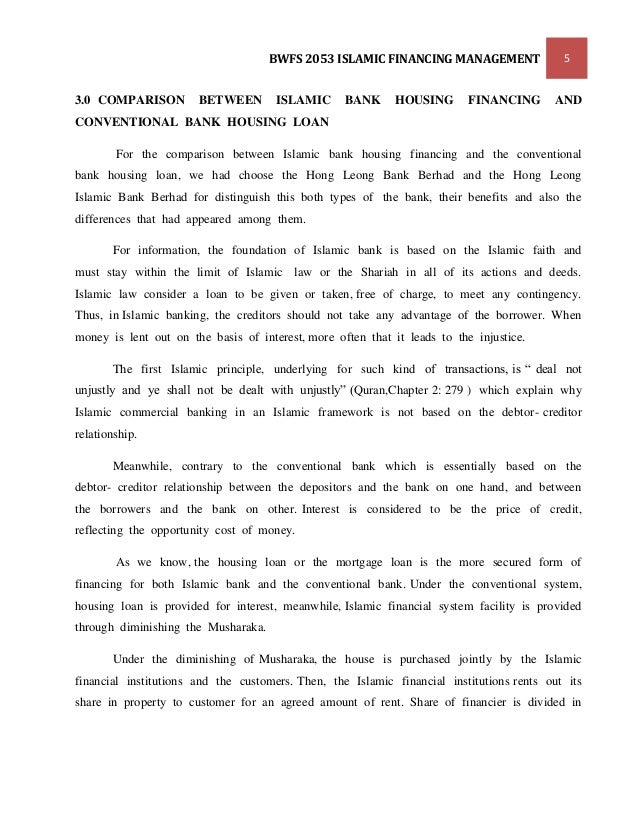

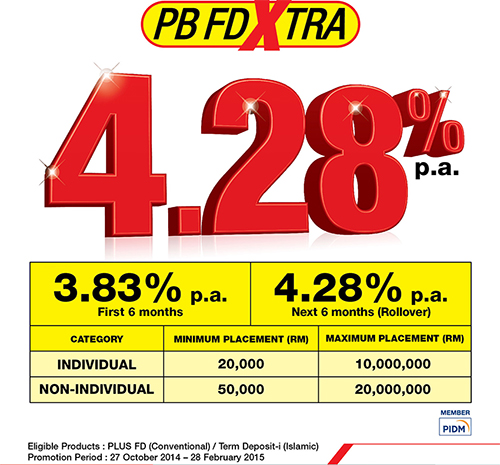

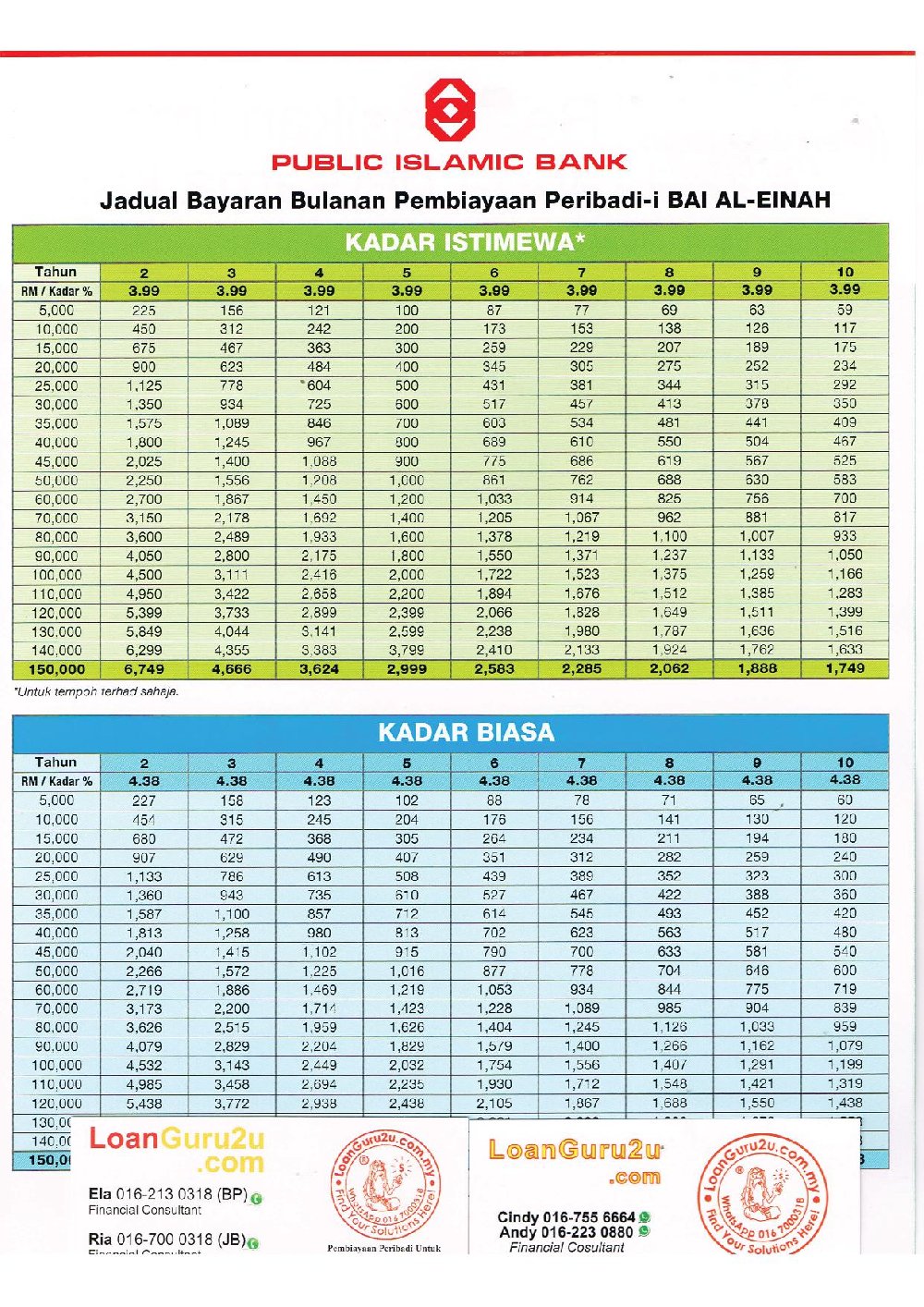

The interest rate is variable tied to ibr. Public islamic bank gives no warranty as to the entirety accuracy or security of the linked web site or any of its content. Public islamic bank gives no warranty as to the entirety accuracy or security of the linked web site or any of its content. An islamic loan plan is available under public bank housing loan which enable you to enjoy fixed profit rates that are not subject to fluctuation in blr.

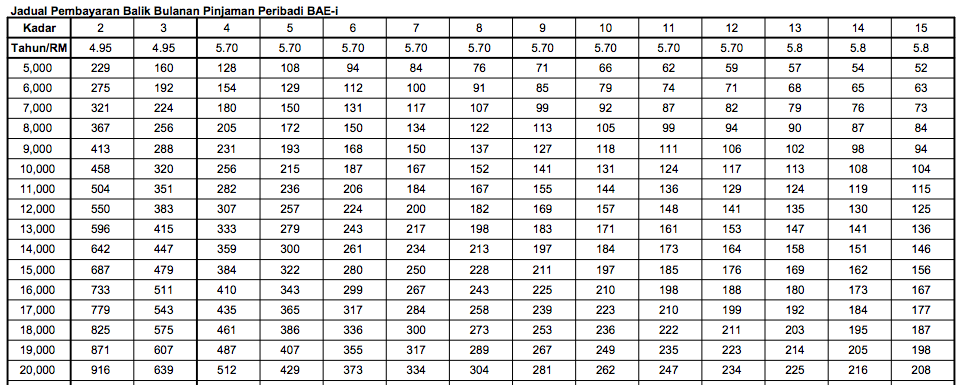

Depending on your circumstance and income you can choose between a full flexible or semi flexible package. This islamic home loan offers variable profit rate fixed to the ibr and is suitable for purchasing of new property and refinancing the existing one. Public islamic bank berhad. Normally the bank is granting a combined loan term loan construction.

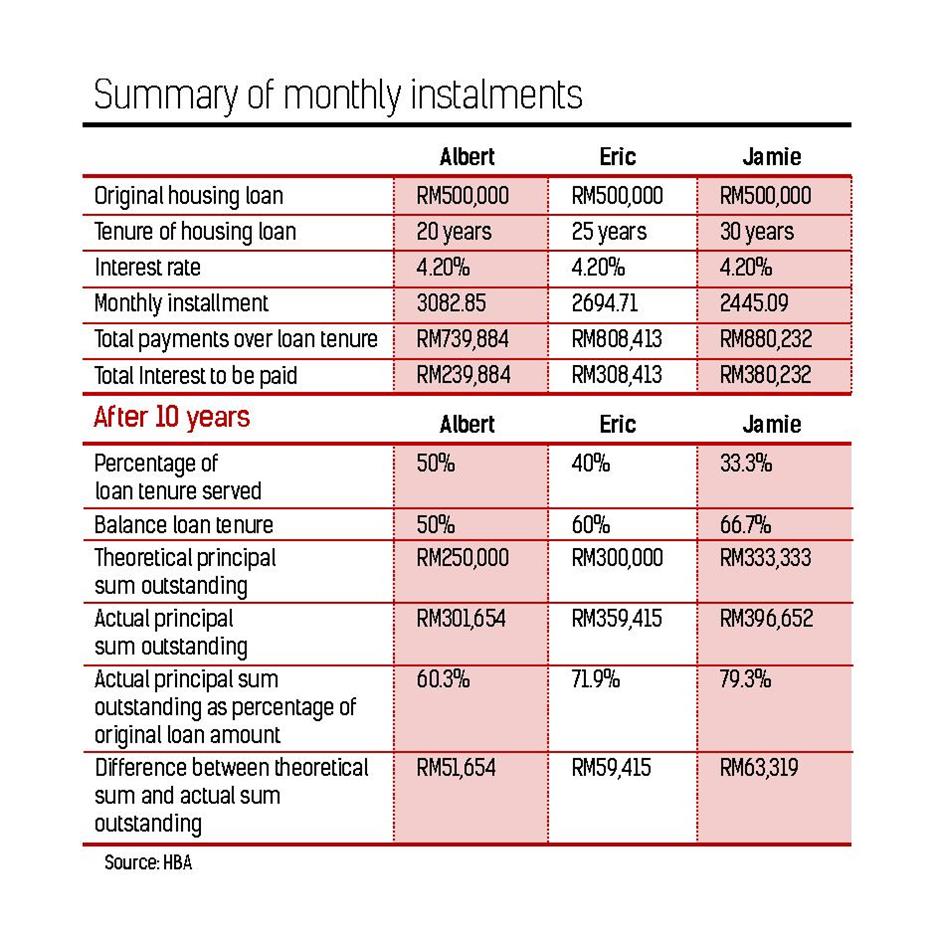

Now it s time to choose your home loan. Public bank home equity financing i is a housing finance plan based on the shariah concept of diminishing partnership. You re getting a term loan financing for the land strictly residential only 70 to 80 margin for the construction cost only for bungalow. The public islamic bank housing loan calculator will display the interest rate that you will incur on your home loan and the monthly loan repayment.

Your islamic home loan account can be combined with an overdraft facility cash line facility i where you borrow up to an agreed limit to use for personal investment or emergency. To ensure a comfortable monthly installment amount we offer a long loan tenure of up to 35 years. Public islamic bank shall not be responsible or liable for any loss or damage suffered or incurred whether directly or indirectly for any content of or any transactions entered via the linked web site.