Types Of Bonds In Malaysia

While our investment services have a variety of bond funds we have gone even further and now offer you the opportunity to access different types of bonds in the market.

Types of bonds in malaysia. You can find the information on maturity and payment schedule of the bond at bix malaysia by typing in the stock code of the bond in the comprehensive search function on bix malaysia homepage. Cimb investment bank berhad. When the treasury sells a bond it gives a bond away and accepts cash for it. The impact of issuing government bonds by selling bonds the treasury reduces the supply of money in the market.

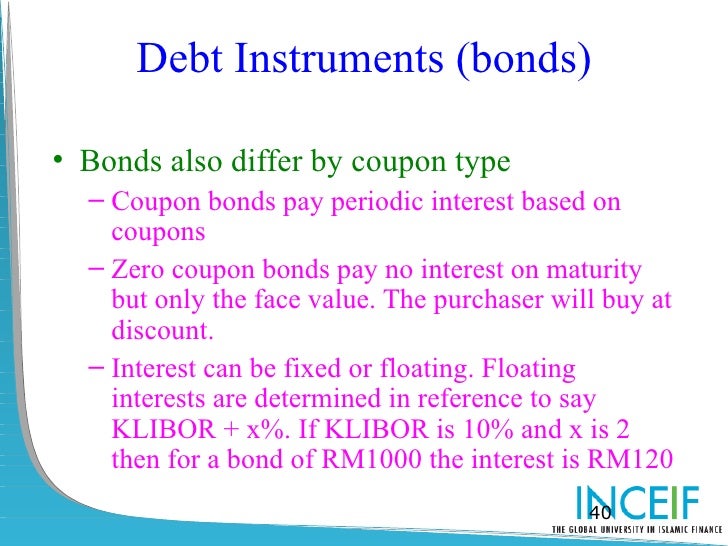

Standard chartered allows you the freedom to select the bonds of your choice from our comprehensive range offered to help diversify your investment portfolio. For investors who willing to take on more risk they can consider the wide variety of corporate bonds currently available on fsm bond. They always have fix term maturity can bear a coupon and trade on the normal yield price relationship. After knowing a little more about bonds a type of fixed income of securities and one of the three main parts of the assets in our portfolio besides stocks and cash we as a knowledgeable investor shall find ways to balance our portfolio.

For conventional investors the structuring of the bonds by the issuer is immaterial. Read more on risk and return of investing in bond and sukuk here at bix malaysia articles and tutorials. Islamic bonds are similar to conventional bonds in malaysia. Imm technology sdn bhd previously known as iljin materials malaysia sdn bhd bonds with detachable warrants.

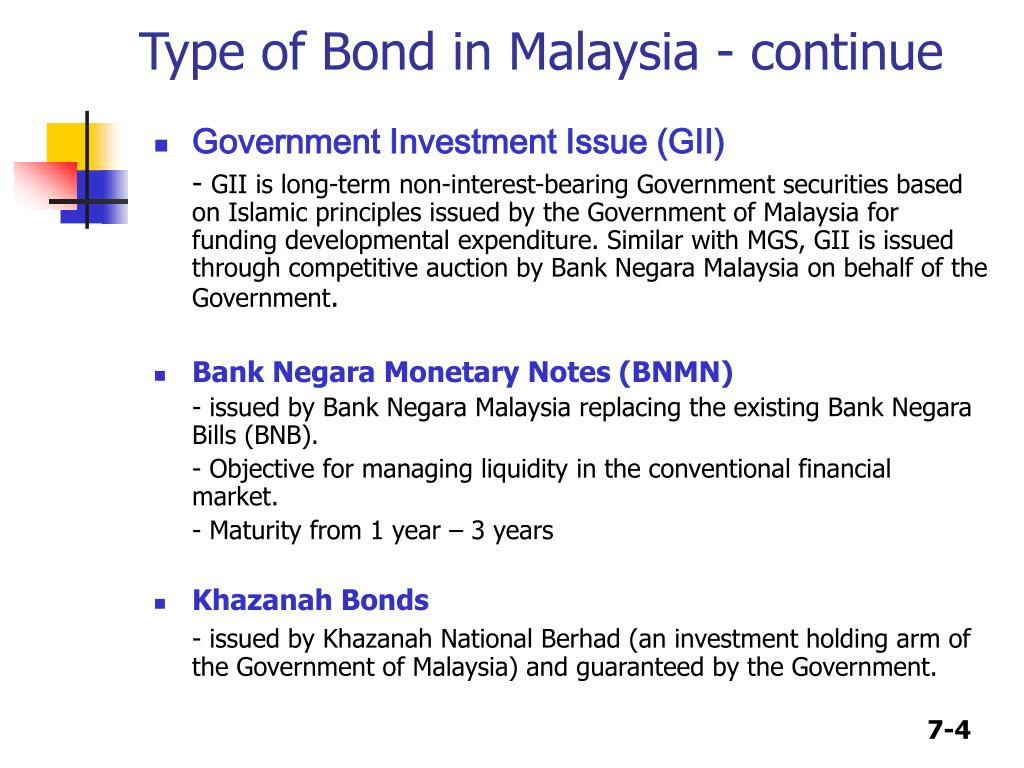

In malaysia corporate bonds are predominantly issued to sophisticated investors. The lcy government bond market grew 3 9 q o q as outstanding central government bonds and central bank bills increased. Imm technology sdn bhd previously known as iljin materials malaysia sdn bhd perpetual convertible bonds. Bank negara malaysia bnm also issues rulings for approvals for certain types of bonds including non tradable and non transferable bonds issued to non residents.

The lcy bond market of malaysia expanded 2 9 quarter on quarter q o q in the first quarter 2020 reaching a size of myr1 527 8 billion usd353 7 billion supported by expansions in lcy government and corporate bonds. For risk averse investors malaysia government securities are good alternatives since these bonds are issued by the malaysia government and are widely considered to be free from credit risk. A reduced supply of money means less inflation. Provides comprehensive malaysia s bonds market information and analysis yield curve for malaysian goverment bond malaysian government securities mgs islamic bond cagamas khazanah bond and corporate bond.